stock information

()

high

low

open

volume

Investor

()

- high

- low

- open

- volume

Financial Highlights 2024

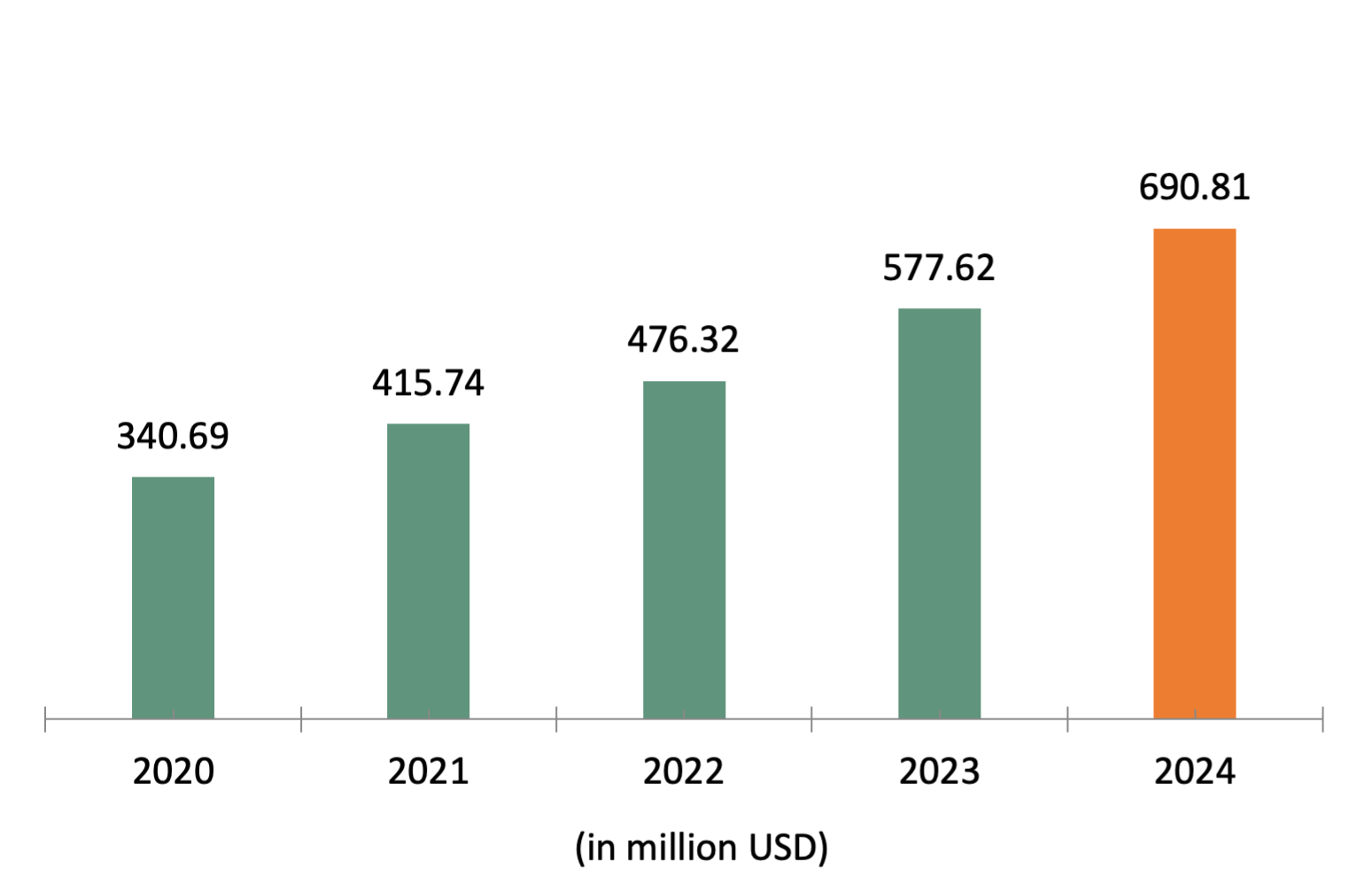

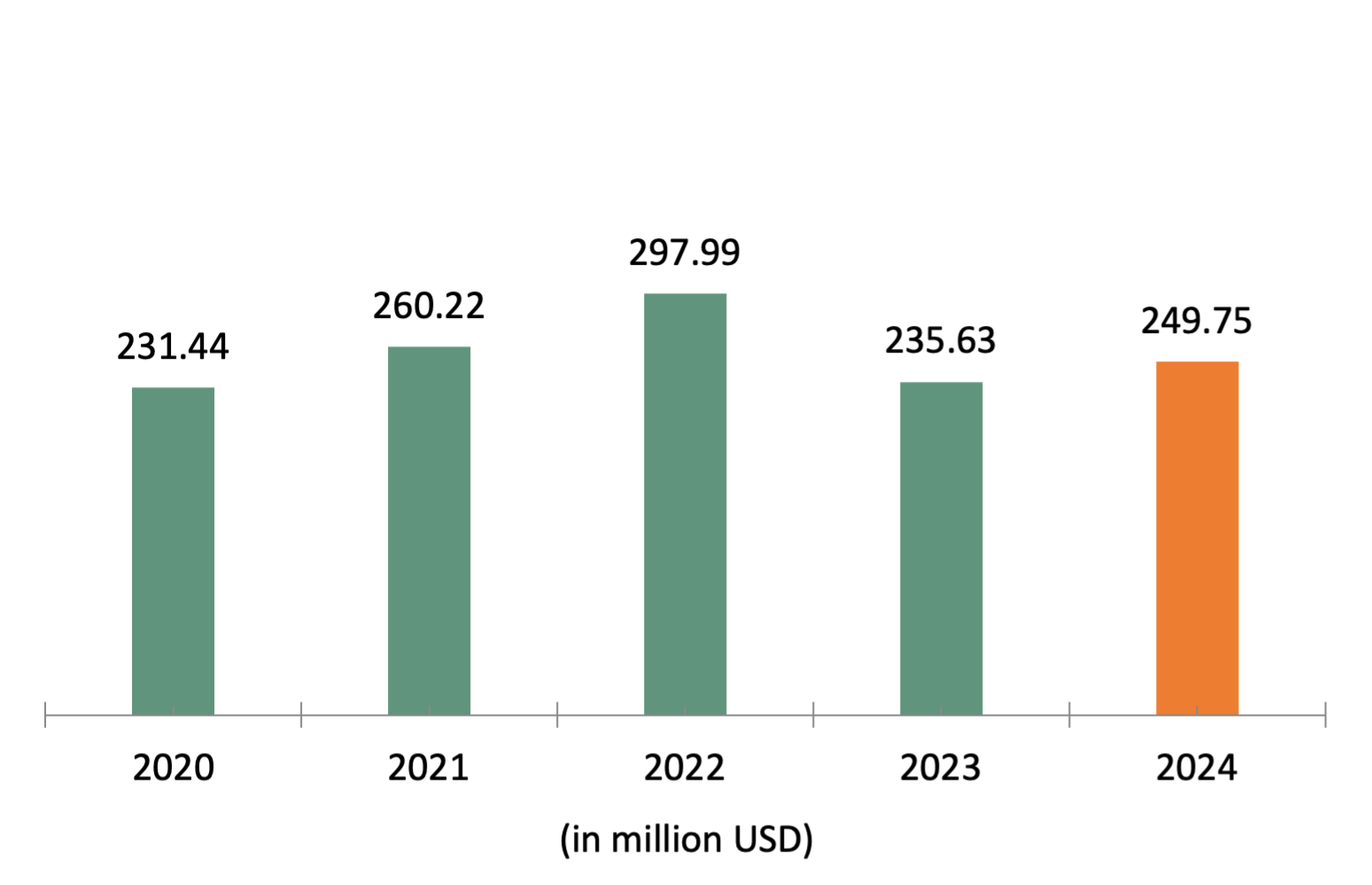

REVENUE

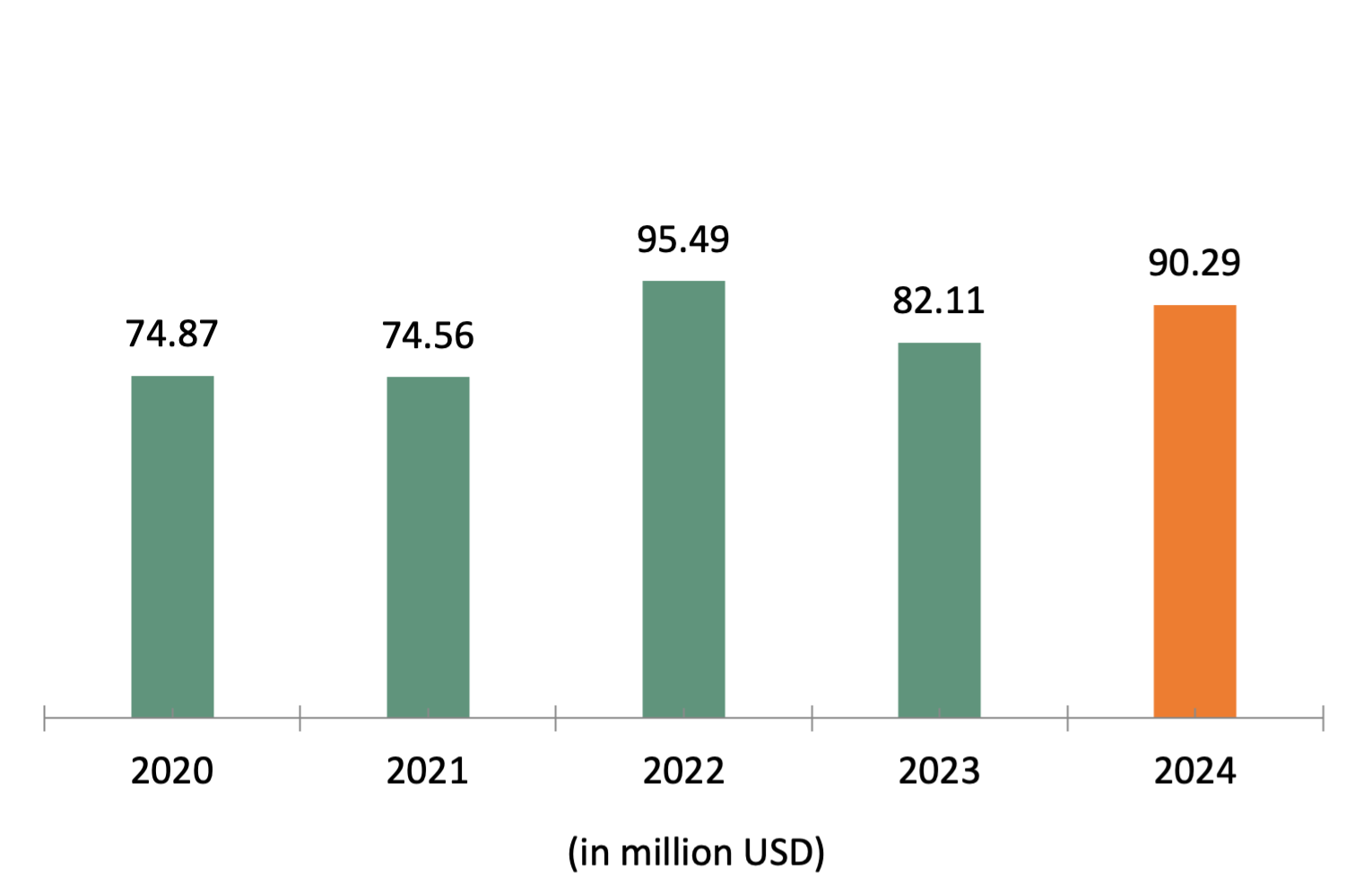

690.81 Million USDGROSS PROFIT

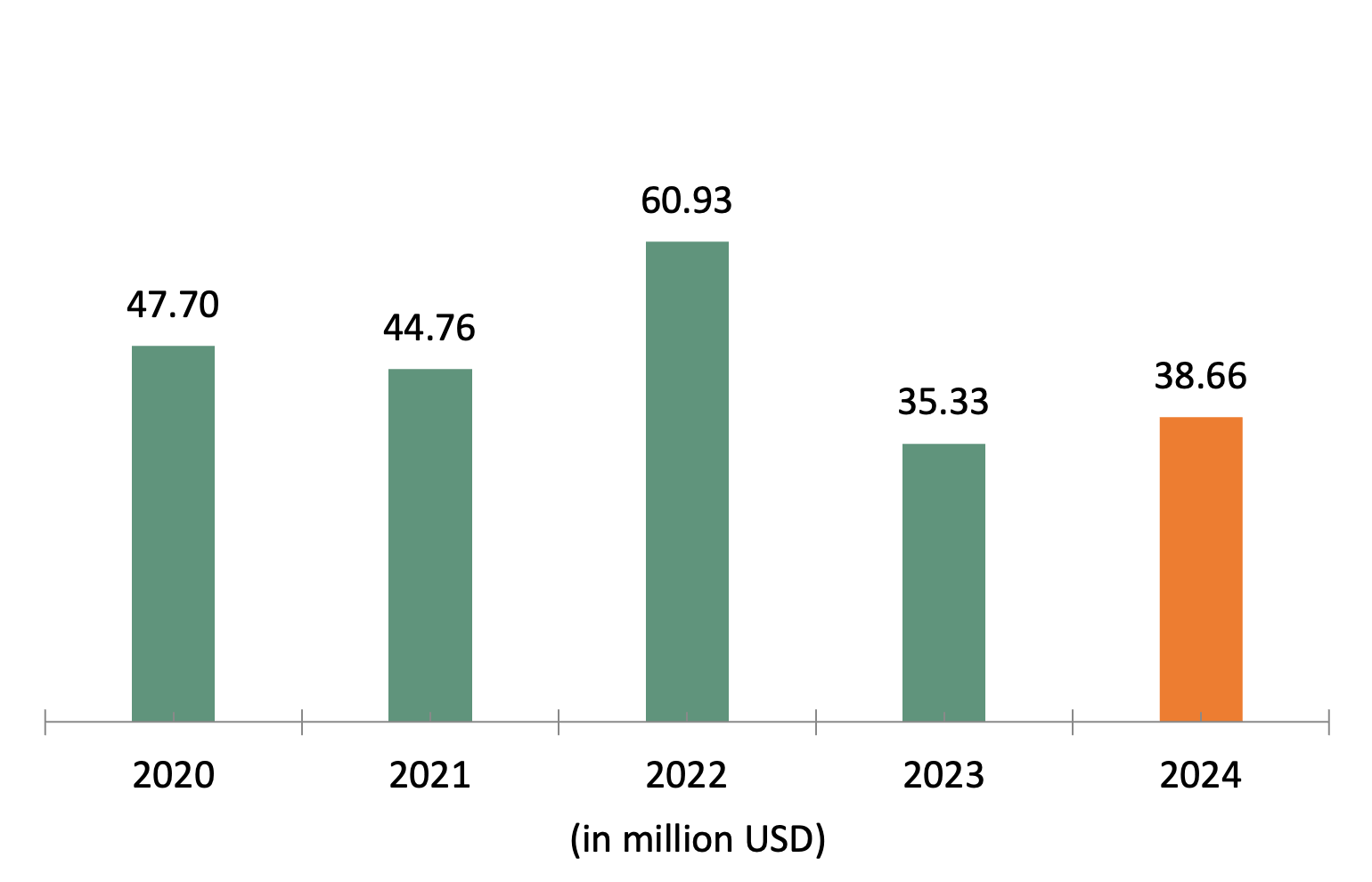

90.29 Million USDOPERATING PROFIT

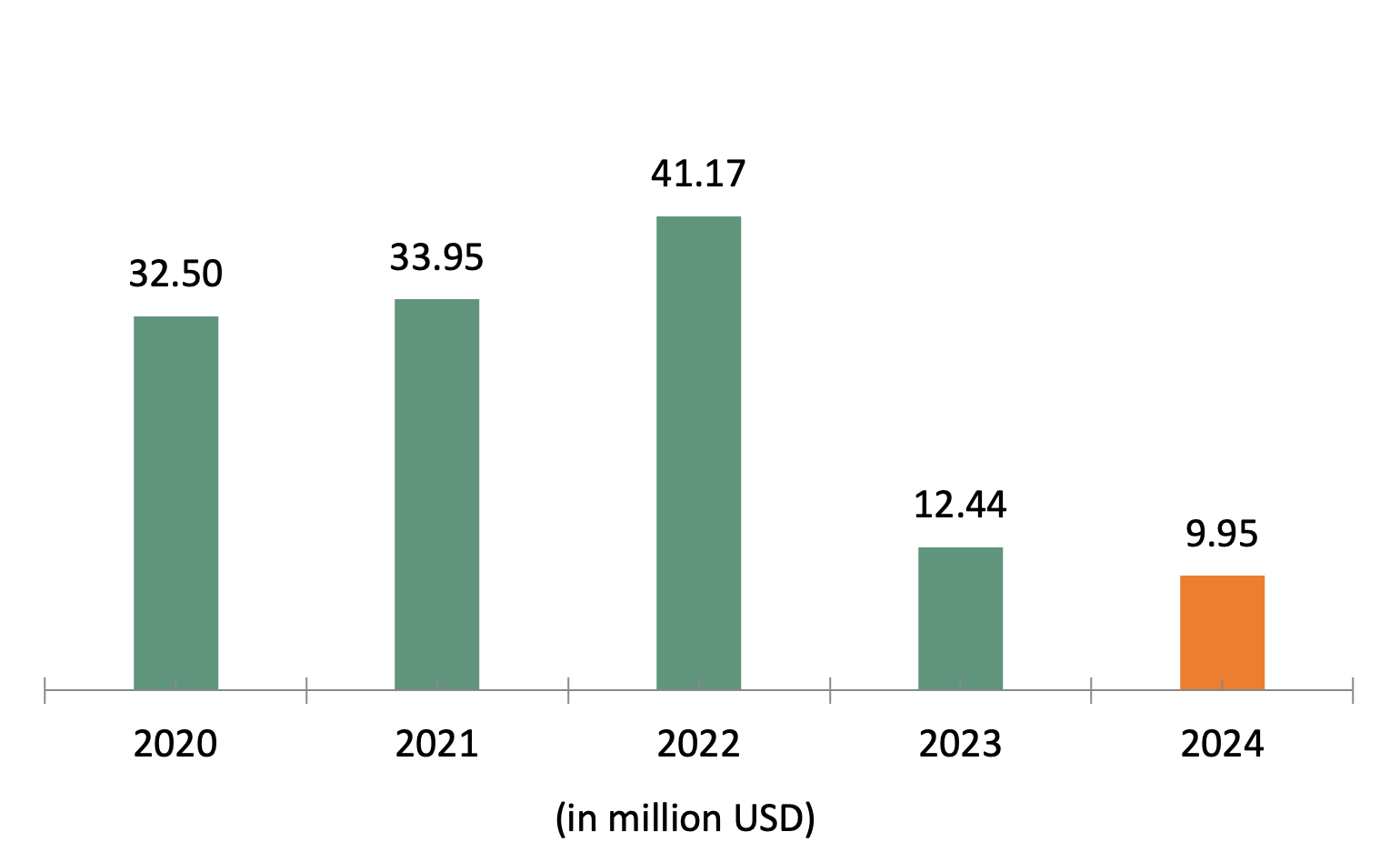

38.66 Million USDPROFIT (LOSS) FOR THE YEAR

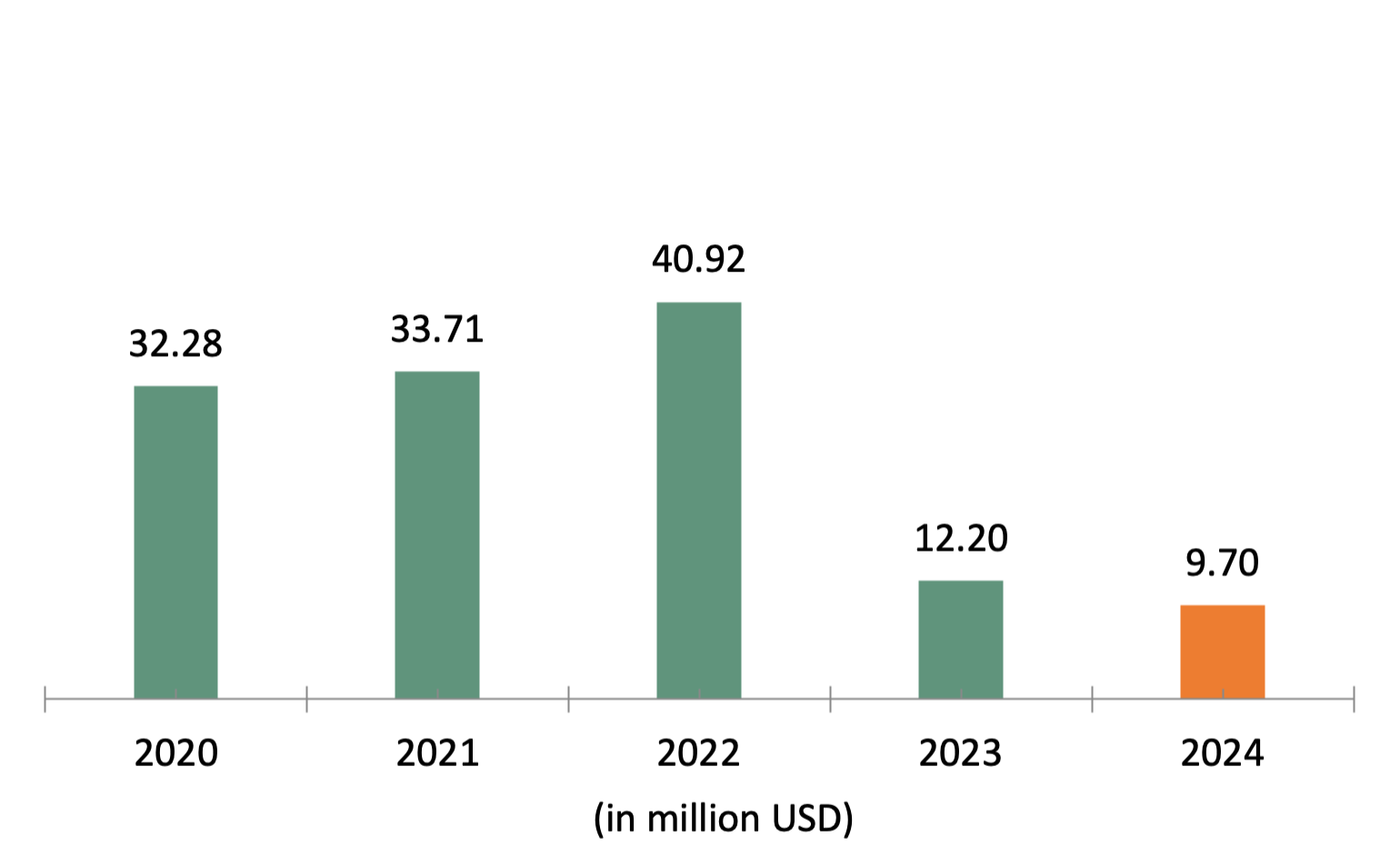

9.95 Million USDPROFIT ATTRIBUTABLE TO OWNERS OF THE COMPANY

9.70 Million USDPROFIT ATTRIBUTABLE TO NON-CONTROLLING INTEREST

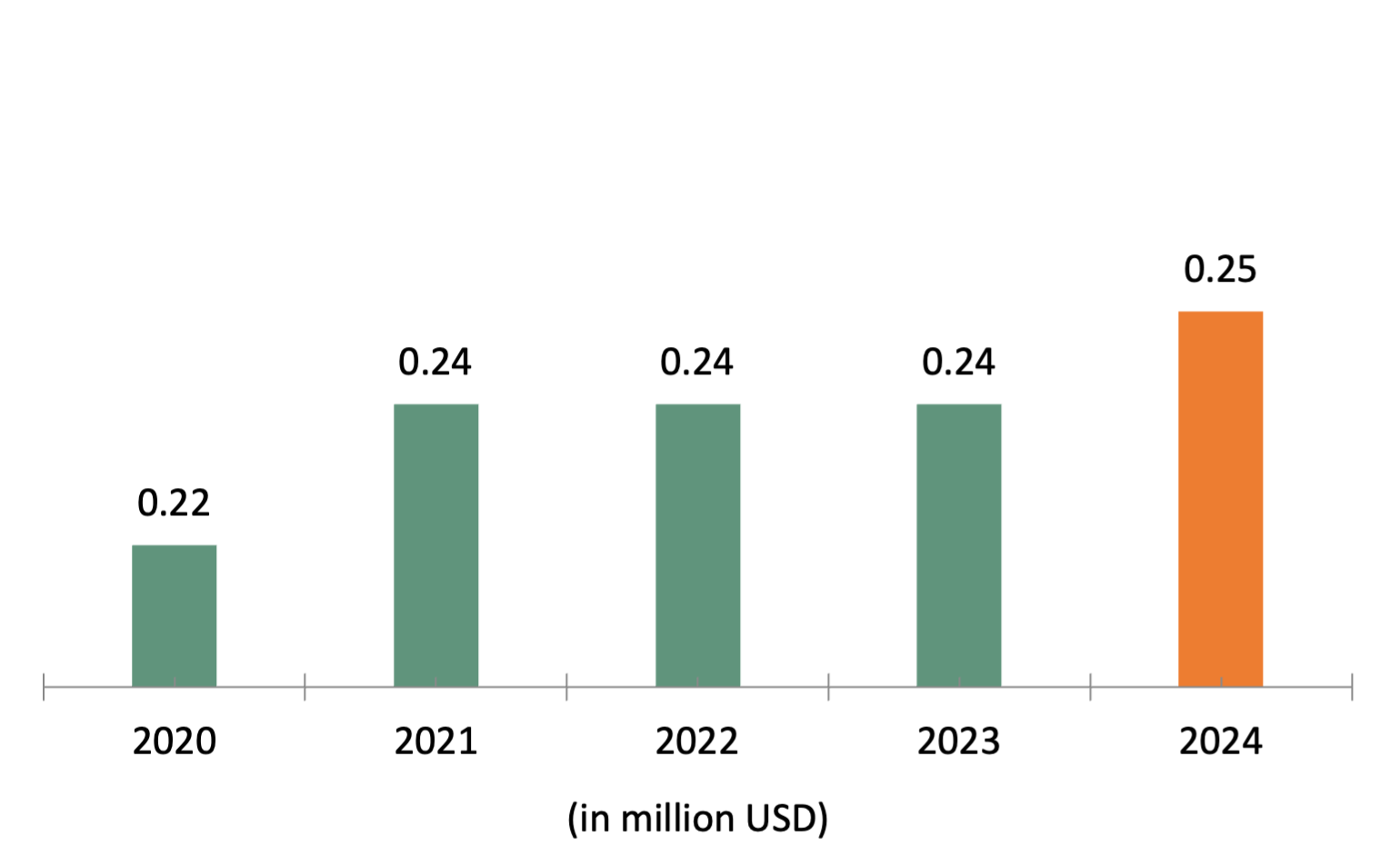

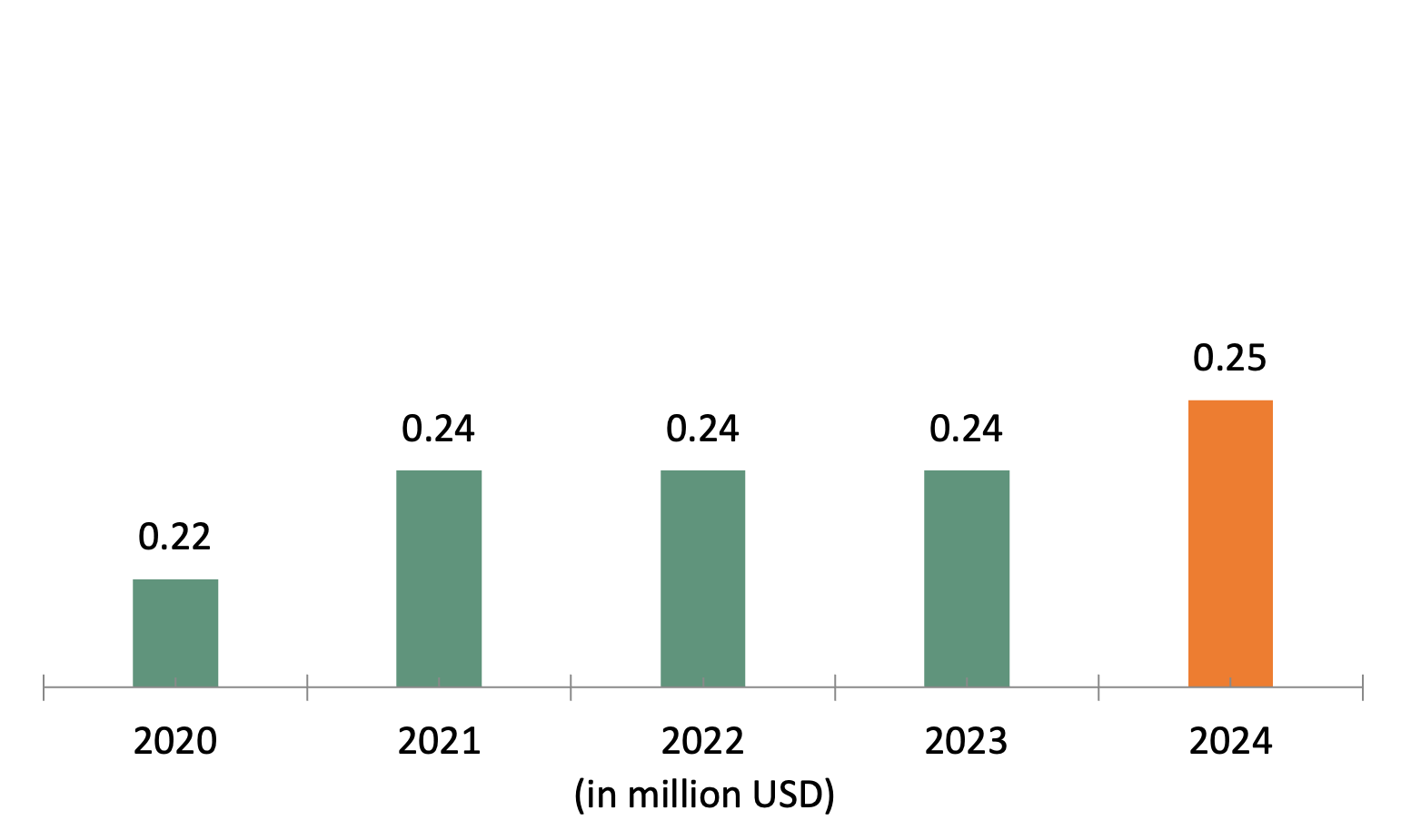

0.25 Million USDTOTAL COMPREHENSIVE INCOME FOR THE YEAR

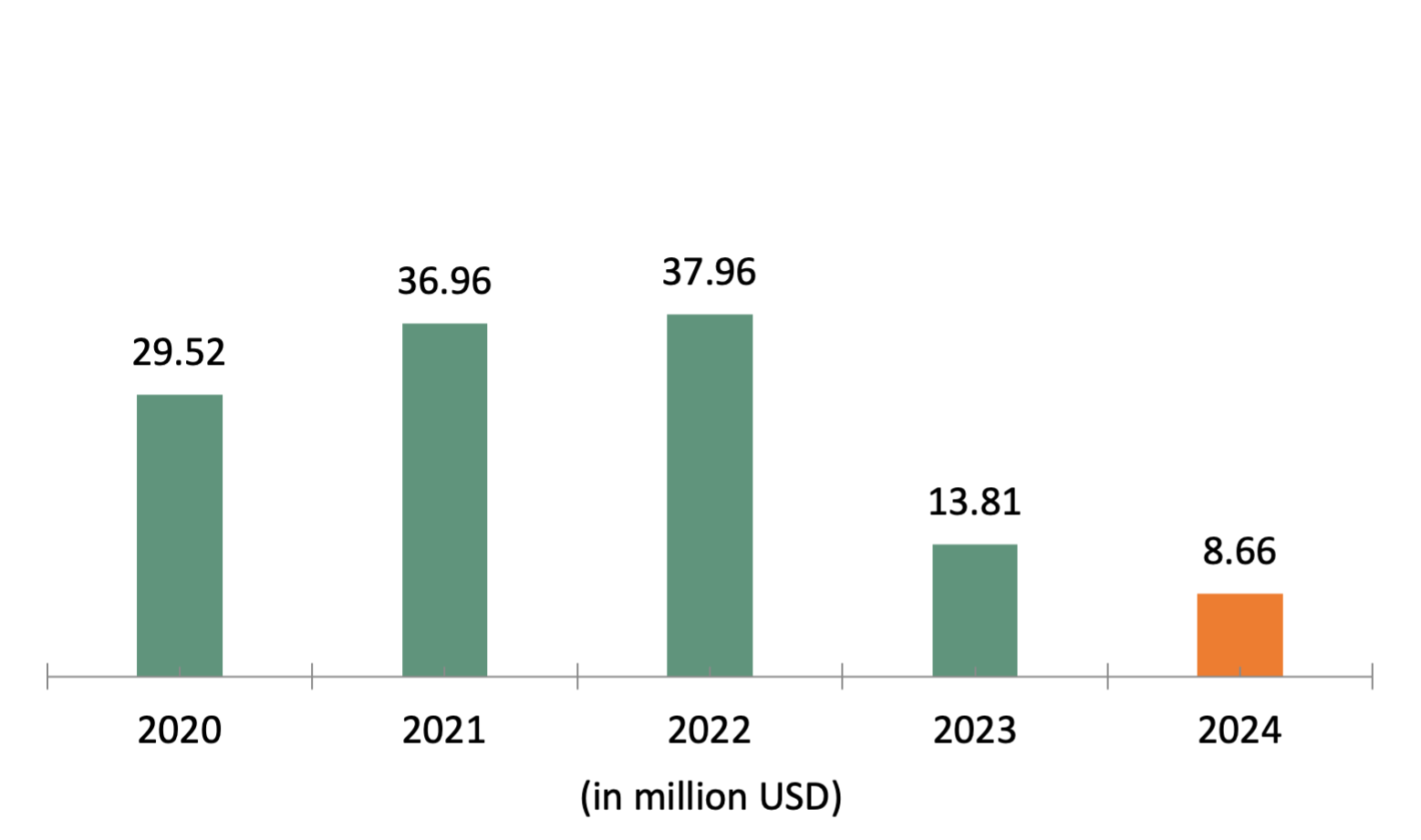

8.66 Million USDTOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO OWNERS OF COMPANY

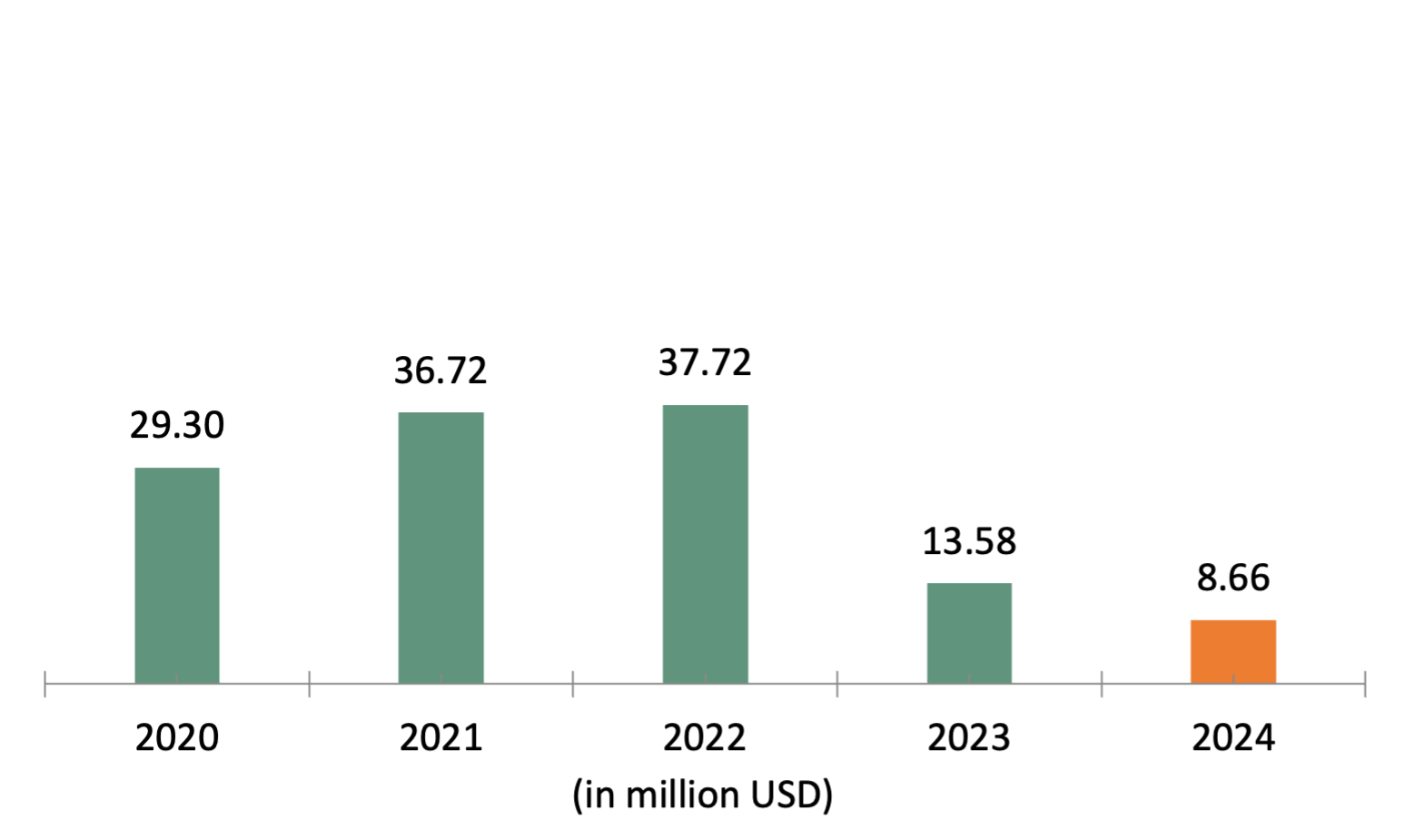

8.66 Million USDTOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO NON-CONTROLLING INTEREST

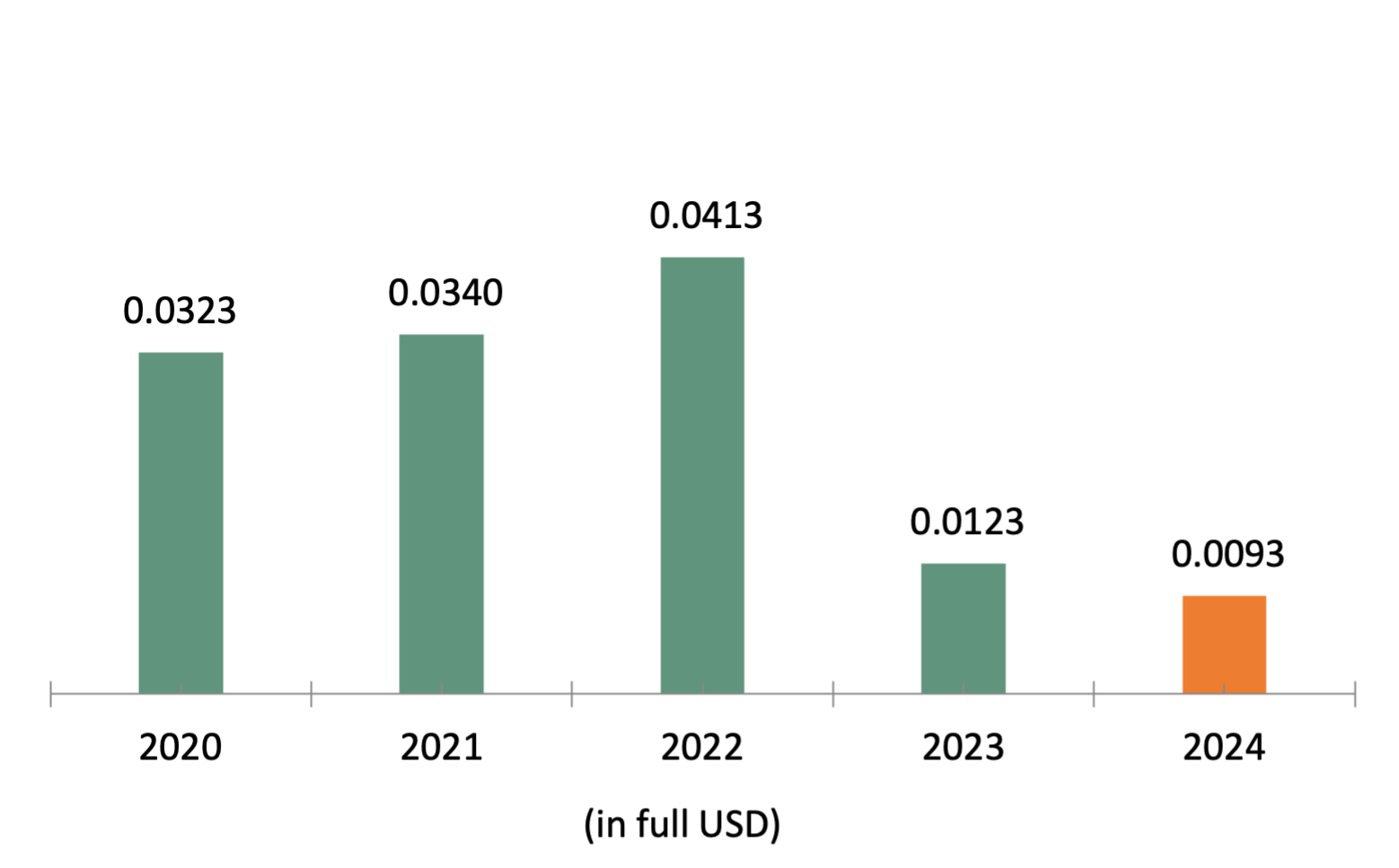

0.25 Million USDBASIC/ DILUTED EARNINGS PER SHARE

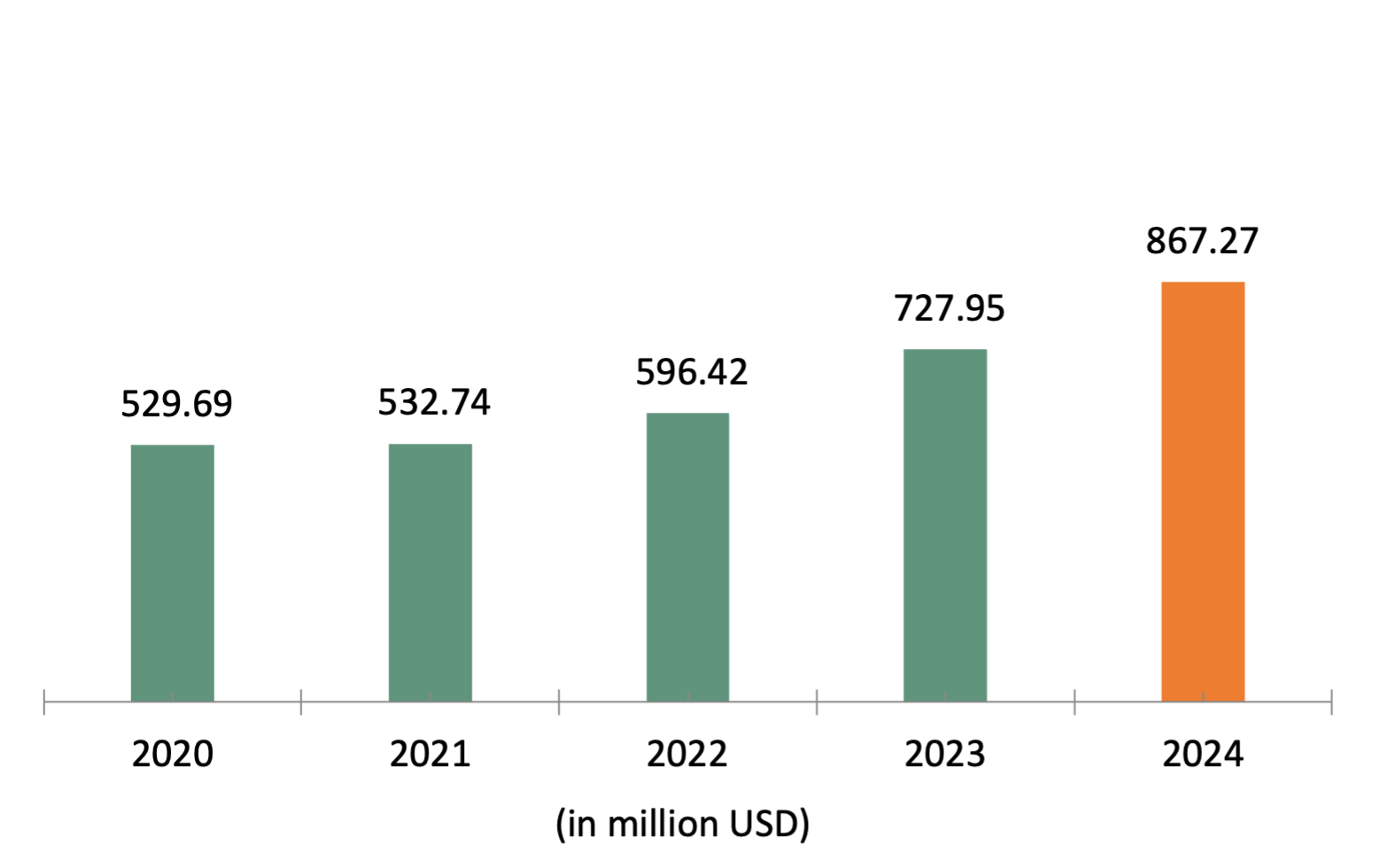

0.0093 Full USDTOTAL ASSETS

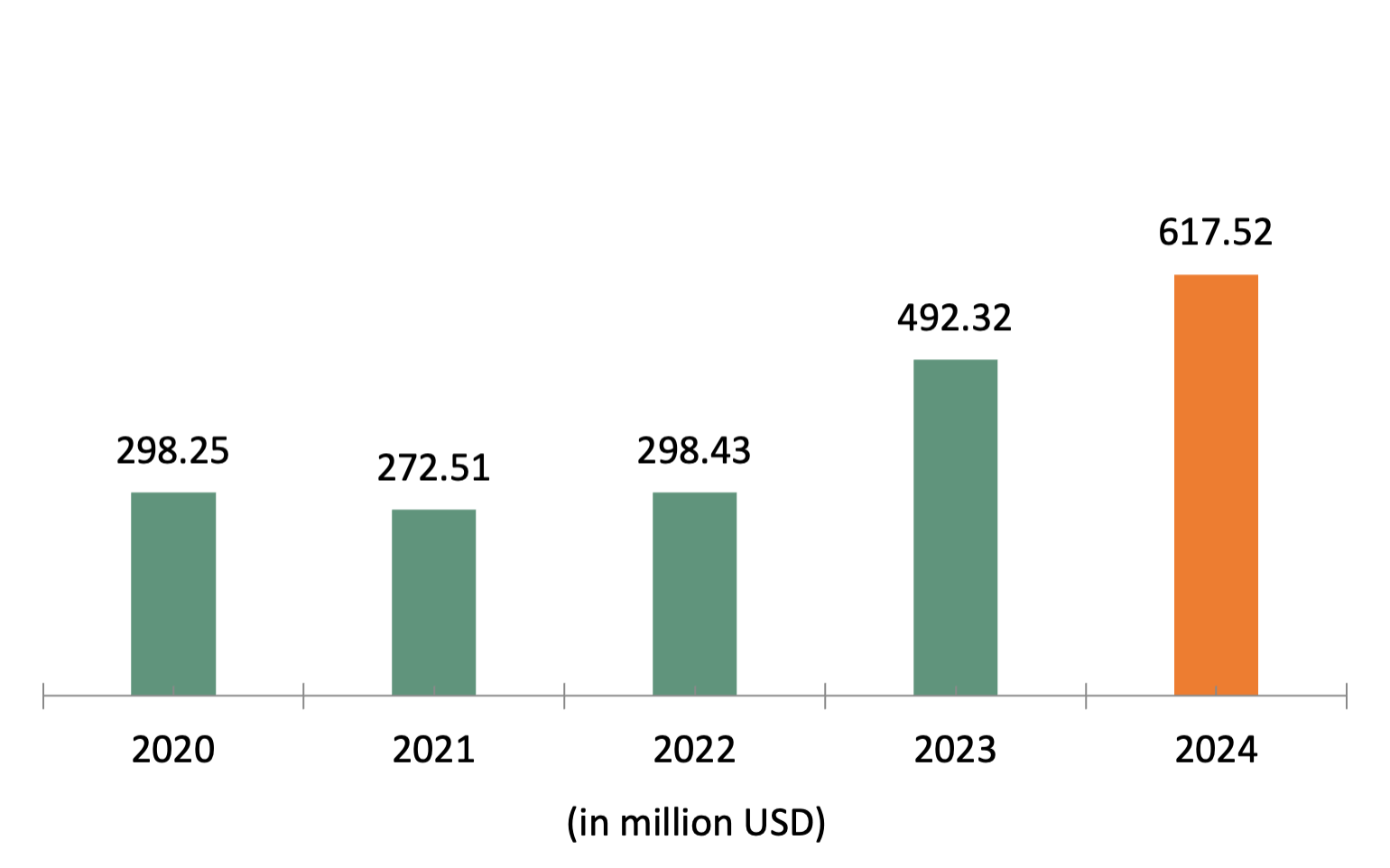

867.27 Million USDTOTAL LIABILITIES

617.52 Million USDTOTAL EQUITY

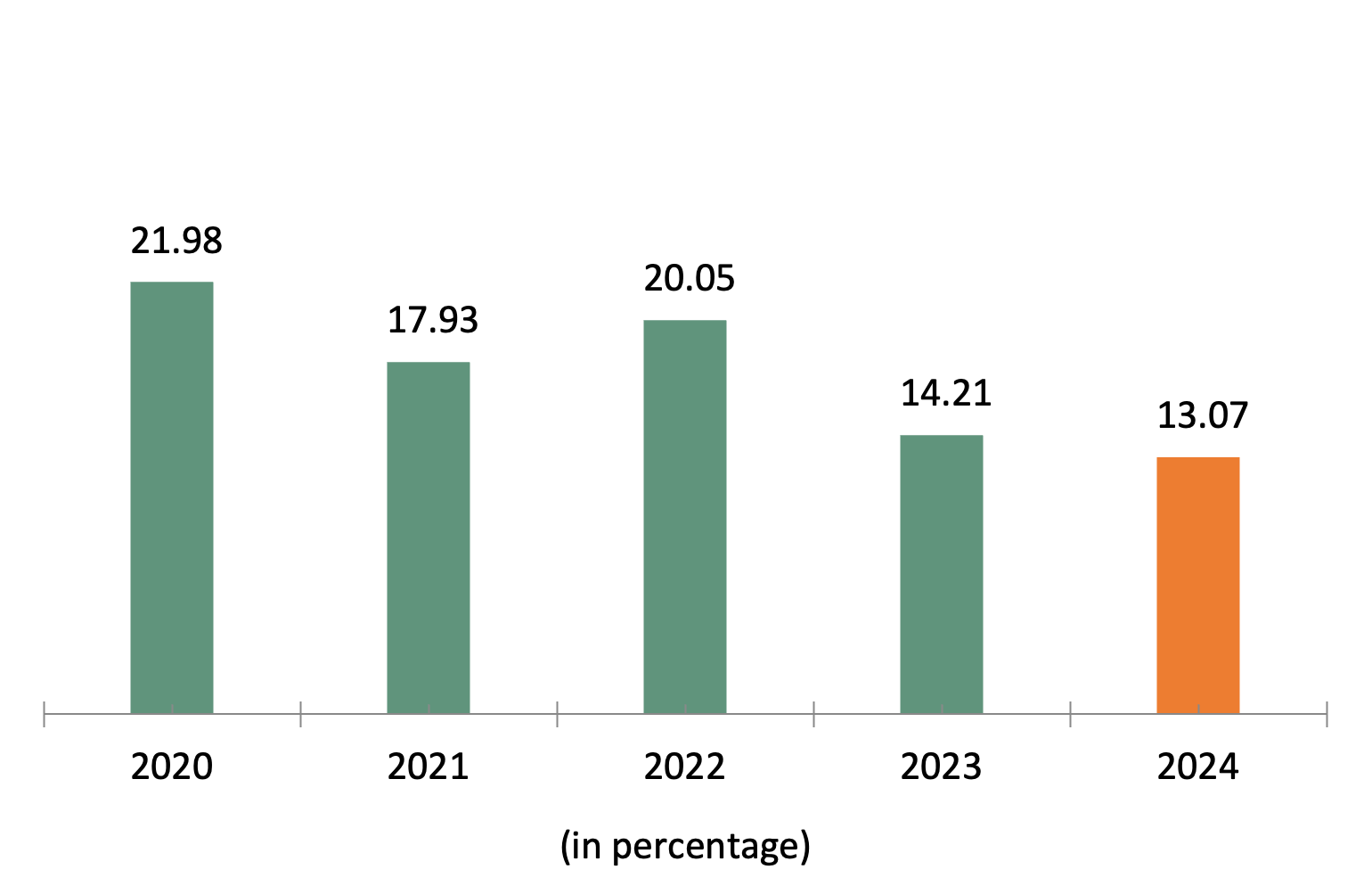

249.75 Million USDGROSS PROFIT MARGIN (%)

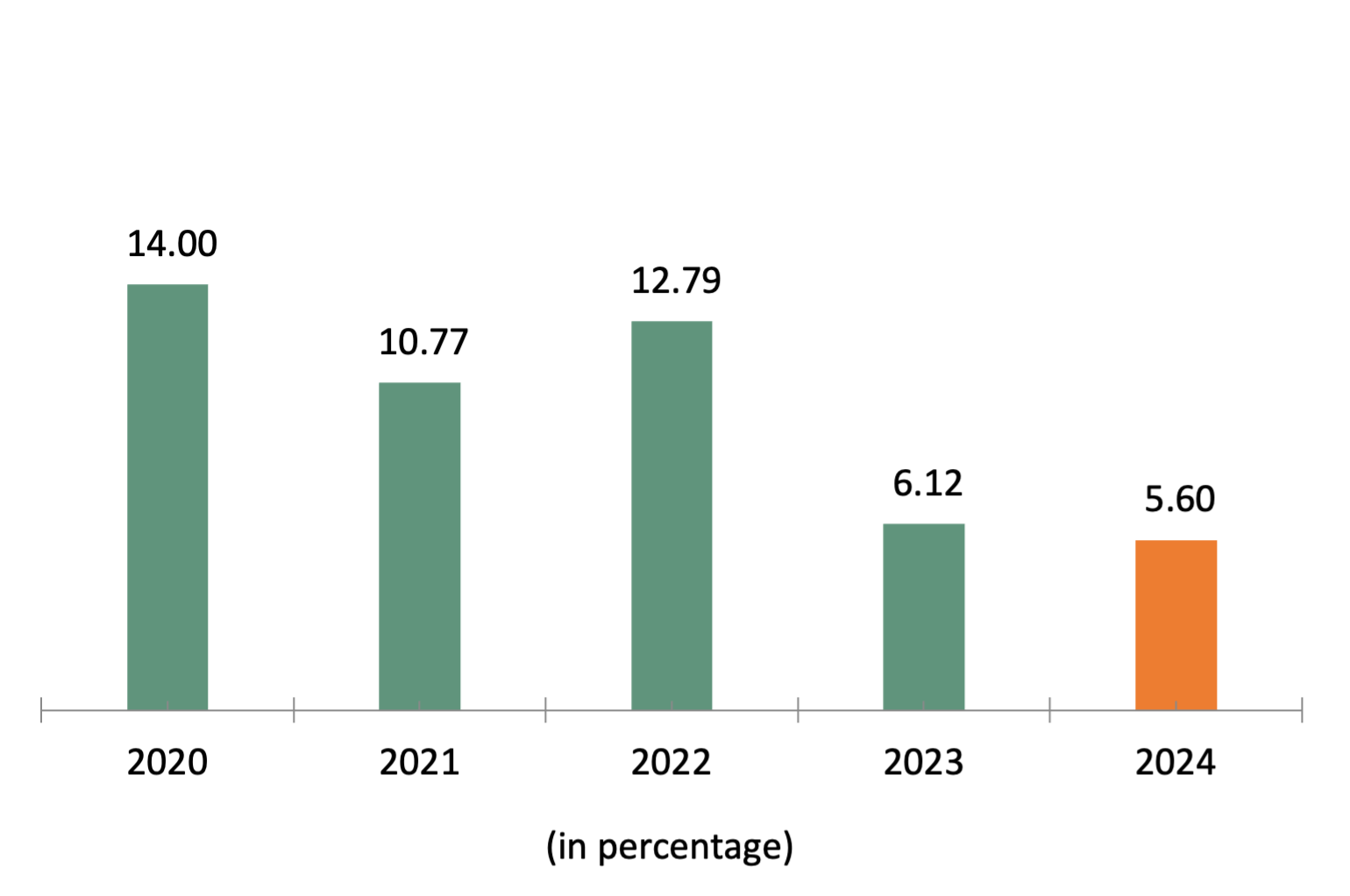

13.07OPERATING PROFIT MARGIN (%)

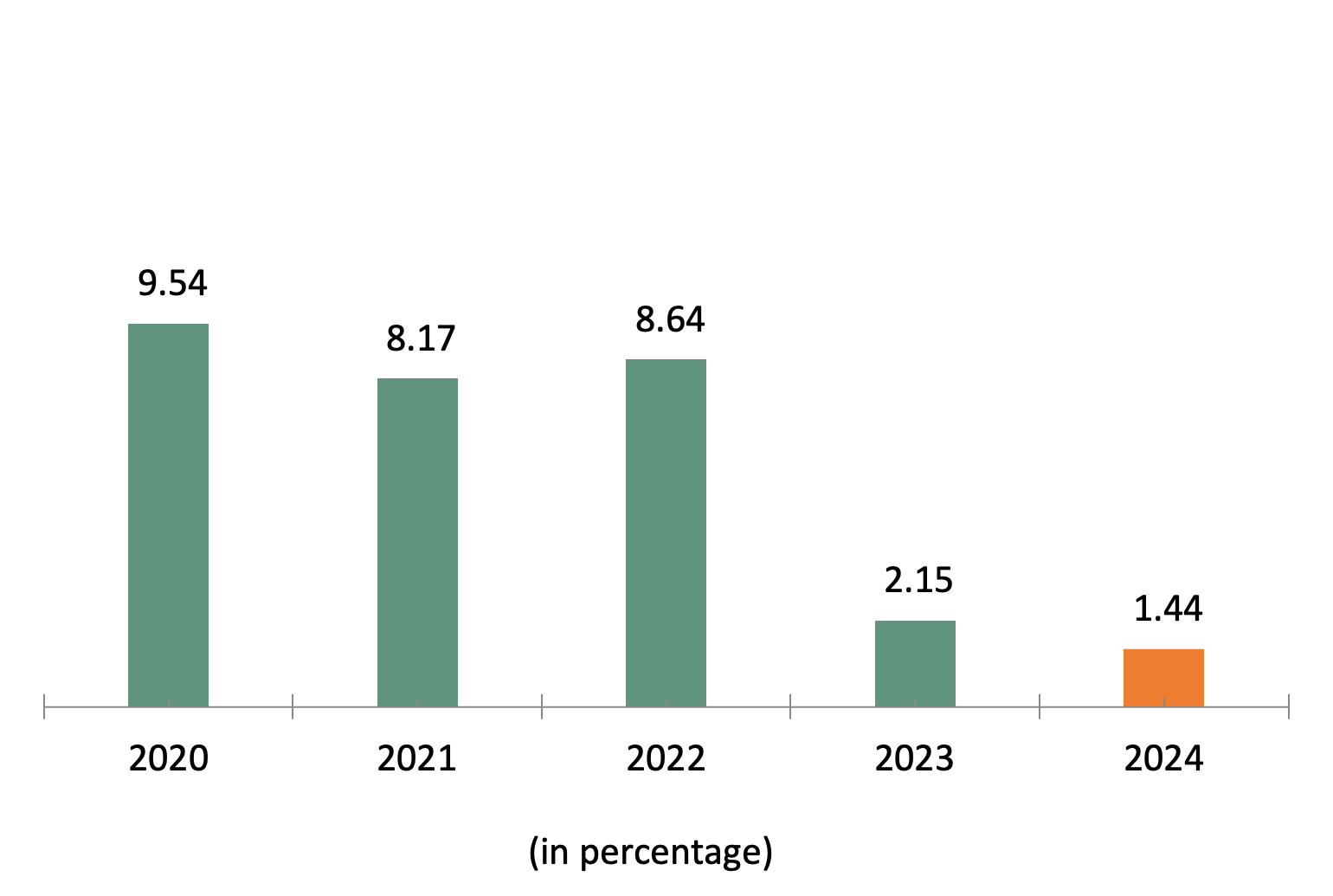

5.60NET PROFIT MARGIN (%)

1.44RETURN ON ASSET (%)

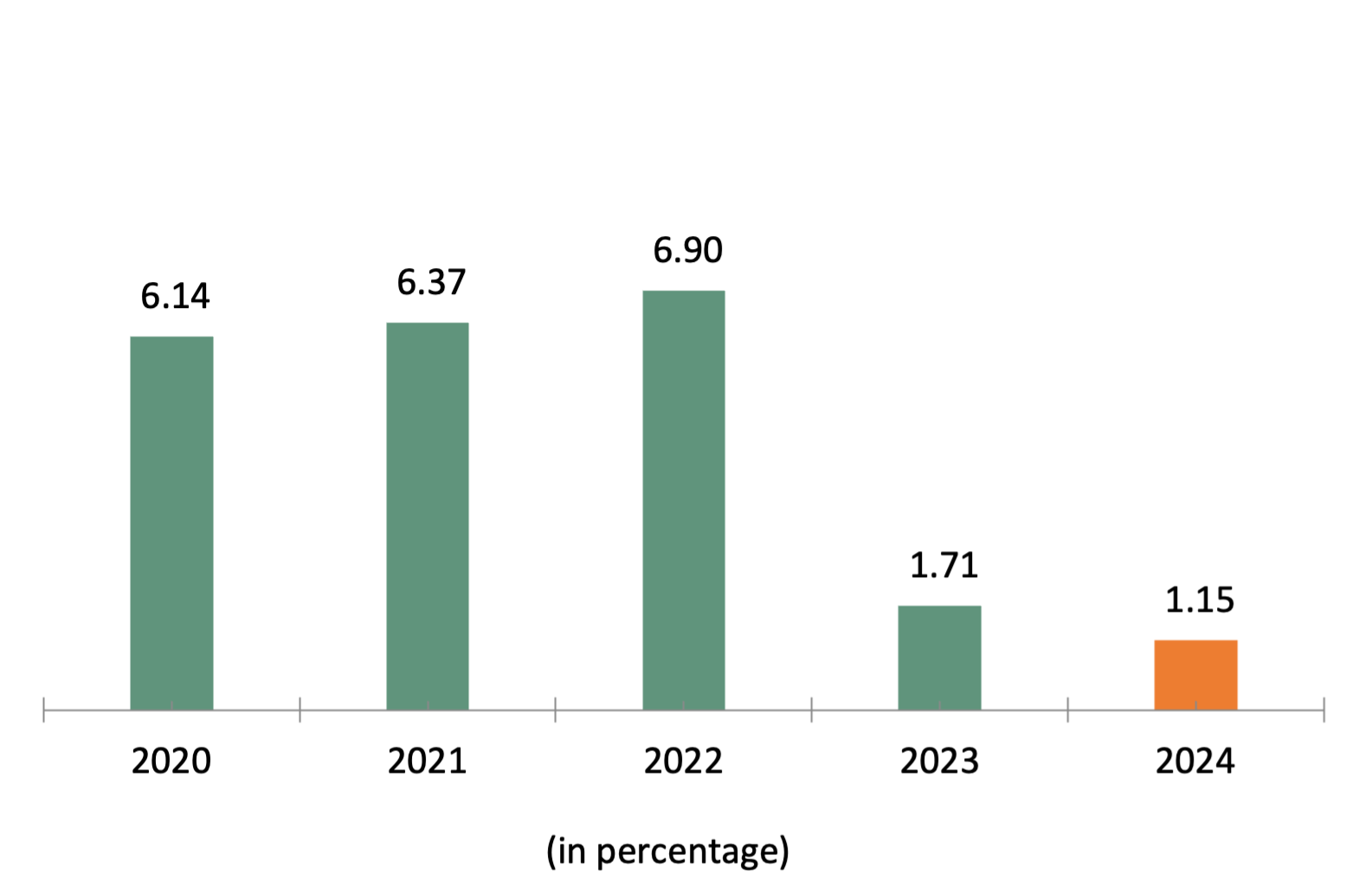

1.15RETURN ON EQUITY (%)

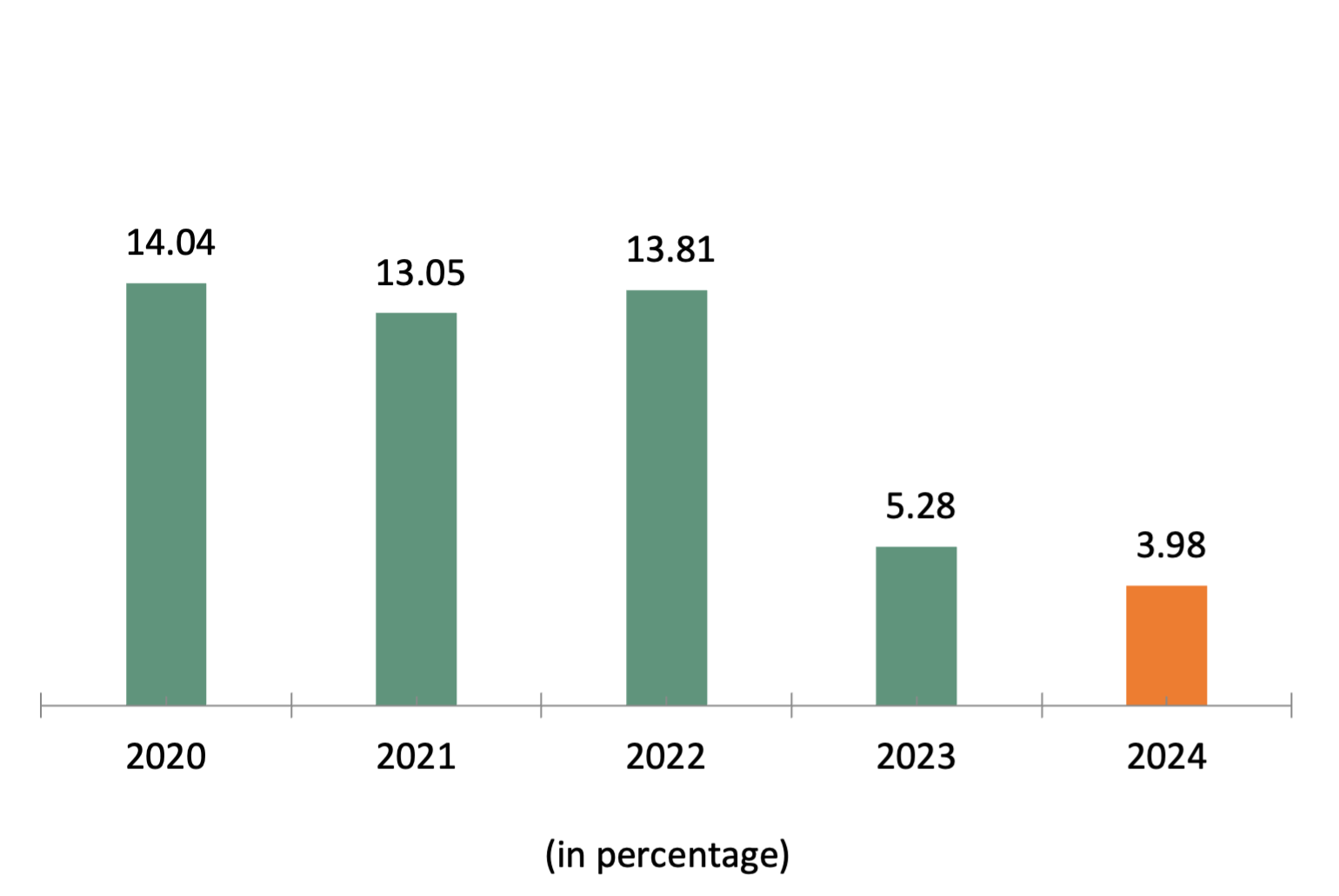

3.98CURRENT RATIO (X)

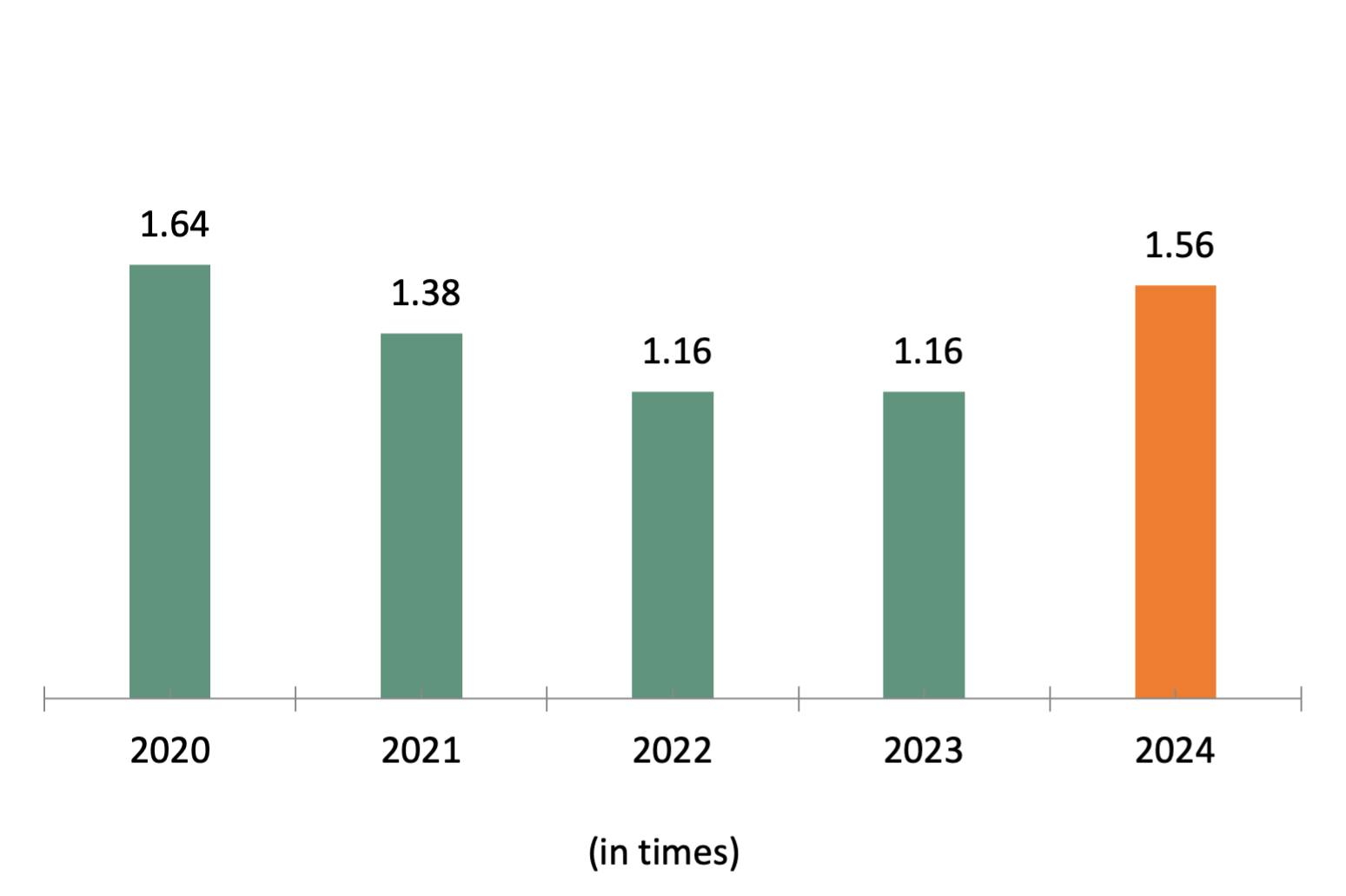

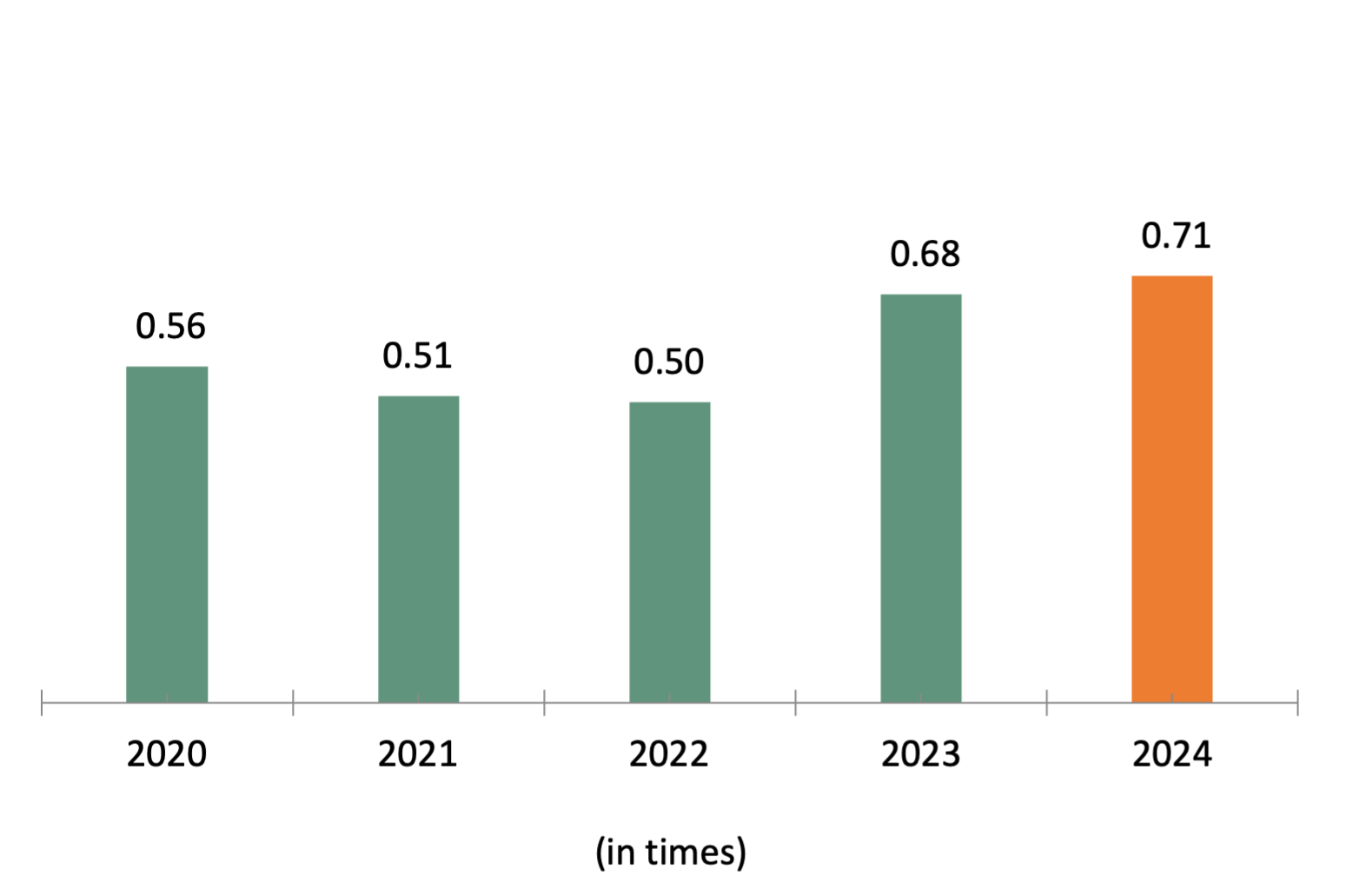

1.56LIABILITIES TO EQUITY RATIO (X)

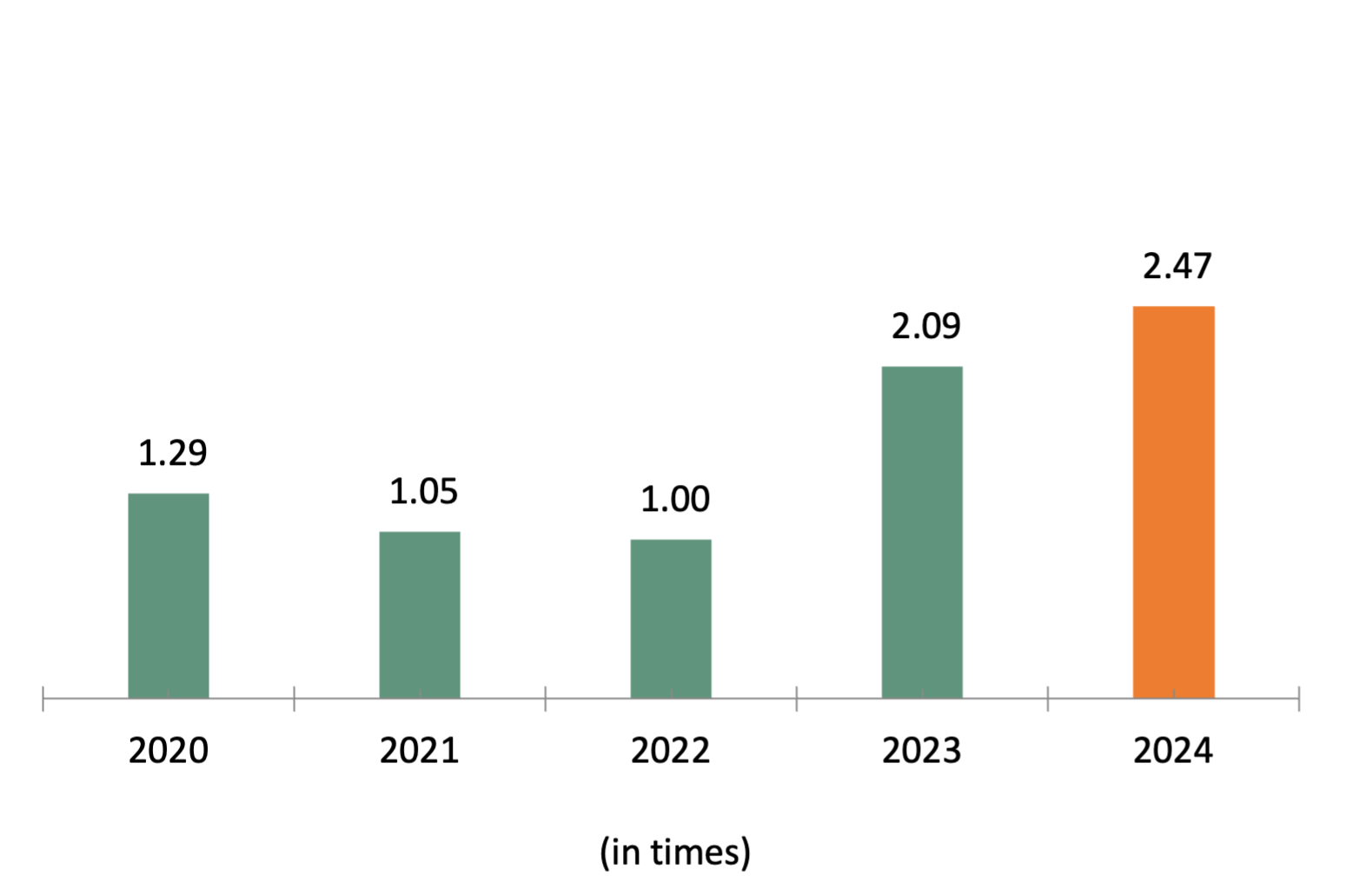

2.47LIABILITIES TO ASSET RATIO (X)

0.71Dividend

2024

0.00099147

Dividend per Share (US$)

Date Paid : 22 May 2025

10,086,050,000

Number of Shares

2023

0.00308

Dividend per Share (US$)

Date Paid : 14 May 2024

991,664,500 (excluding treasury stock)

Number of Shares

2022

0.07664

Dividend per Share (US$)

Date Paid : 31 May 2023

991,664,500 (excluding treasury stock)

Number of Shares

2021

-

Dividend per Share (US$)

Date Paid :

991,664,500 (excluding treasury stock)

Number of Shares

2020

0.00807

Dividend per Share (US$)

Date Paid : 3 June 2021

991,664,500 (excluding treasury stock)

Number of Shares

2019

0.0309

Dividend per Share (US$)

Date Paid : 15 May 2020

1,008,605,000

Number of Shares

2018

0.0228

Dividend per Share (US$)

Date Paid : 24 May 2019

1,008,605,000

Number of Shares

2017

0.0115

Dividend per Share (US$)

Date Paid : 18 May 2018

1,008,605,000

Number of Shares

2016

-

Dividend per Share (US$)

Date Paid :

1,008,605,000

Number of Shares

2015

-

Dividend per Share (US$)

Date Paid :

1,008,605,000

Number of Shares

2014

0.00168

Dividend per Share (US$)

Date Paid : 22 May 2015

1,008,605,000

Number of Shares

2013

0.00694

Dividend per Share (US$)

Date Paid : 14 July 2014

1,008,605,000

Number of Shares

Fixed Income Research

| Company Name | Analyst Name | Date Released | Research Report | Research Report |

| Trimegah Sekuritas | Fakhrul Fulvian, Alpinus Dewangga, Reinaldy Sutanto, Martin Nathanael | 14 Nov 2024 | Growing With Synergy |

Company Name Trimegah Sekuritas Analyst Name Fakhrul Fulvian, Alpinus Dewangga, Reinaldy Sutanto, Martin Nathanael Date Released 14 Nov 2024 |

| Sucor Sekuritas | Yoga Ahmad Gifari | 11 Nov 2024 | Turn Around Story Under New Management |

Company Name Sucor Sekuritas Analyst Name Yoga Ahmad Gifari Date Released 11 Nov 2024 |

Analyst Coverage

| Company Name | Analyst Name | Date Released | Target Price | Research Report | Research Report |

| Samuel Sekuritas | Juan Harahap | 8 Dec 2025 | Rp 17,000 | Perfect Pit-to-Port Projects |

Company Name Samuel Sekuritas Analyst Name Juan Harahap Date Released 8 Dec 2025 Target Price Rp 17,000 |

| Henan Putihrai Sekuritas | Dennis Tay & Tristan Elfan Z. R. | 3 Dec 2025 | Rp 13,100 | Stronger Business Pipeline Drives Higher Target Price |

Company Name Henan Putihrai Sekuritas Analyst Name Dennis Tay & Tristan Elfan Z. R. Date Released 3 Dec 2025 Target Price Rp 13,100 |

| Henan Putihrai Sekuritas | HP Research Team | 21 Oct 2025 | Rp 10,000 | From Gegenpressing to Total Football |

Company Name Henan Putihrai Sekuritas Analyst Name HP Research Team Date Released 21 Oct 2025 Target Price Rp 10,000 |

| Kiwoom Sekuritas | Sukarno Alatas | 15 Jul 2025 | Rp 6,000 | Profitability Rebounds Despite Slower Revenue – PTRO’s MSCI Comeback in Sight |

Company Name Kiwoom Sekuritas Analyst Name Sukarno Alatas Date Released 15 Jul 2025 Target Price Rp 6,000 |

| BRI Danareksa | Timothy Wijaya | 21 Apr 2025 | Not Rated | Loaded With Contracts, Poised to Deliver Rapid Earnings Growth |

Company Name BRI Danareksa Analyst Name Timothy Wijaya Date Released 21 Apr 2025 Target Price Not Rated |

| NH Korindo Sekuritas | Axell Ebenhaezer | 12 Mar 2025 | Rp 4,300 | New Contracts Expected to Boost Earnings |

Company Name NH Korindo Sekuritas Analyst Name Axell Ebenhaezer Date Released 12 Mar 2025 Target Price Rp 4,300 |

| Kiwoom Sekuritas | Sukarno Alatas | 4 Feb 2025 | Rp 6,000 | PTRO Delivers: Strong 9M24 Results & Expansive Future |

Company Name Kiwoom Sekuritas Analyst Name Sukarno Alatas Date Released 4 Feb 2025 Target Price Rp 6,000 |

| Ciptadana Sekuritas | Thomas Radityo | 16 Jan 2025 | Not Rated | Strategic Grow and Synergies Drive Premium Valuation |

Company Name Ciptadana Sekuritas Analyst Name Thomas Radityo Date Released 16 Jan 2025 Target Price Not Rated |

| Henan Putihrai Sekuritas | Tristan Elfan Z. R. | 13 Jan 2025 | Rp 4,500 | Unlocking Future Growth: Strategic Vision and Long-Term Potential |

Company Name Henan Putihrai Sekuritas Analyst Name Tristan Elfan Z. R. Date Released 13 Jan 2025 Target Price Rp 4,500 |

| Kiwoom Sekuritas | Sukarno Alatas | 18 Sep 2024 | Rp 1,450* | Strong Revenue Growth for PTRO, Despite Profit Dip |

Company Name Kiwoom Sekuritas Analyst Name Sukarno Alatas Date Released 18 Sep 2024 Target Price Rp 1,450* |

*Adjusted for 1:10 stock split

Disclaimer: The information provided in this section is for informational purposes only and does not constitute an offer or solicitation to sell or purchase any securities or investment products. All investments involve risk, including the possible loss of principal. The information contained herein is not intended as financial advice and should not be relied upon as such. We recommend that you consult with a qualified financial advisor before making any investment decisions

Disclaimer: The information provided in this section is for informational purposes only and does not constitute an offer or solicitation to sell or purchase any securities or investment products. All investments involve risk, including the possible loss of principal. The information contained herein is not intended as financial advice and should not be relied upon as such. We recommend that you consult with a qualified financial advisor before making any investment decisions

Investor Relations Contact

For further inquiries or more information,

please contact investor.relations@petrosea.com